operating cash flow ratio industry average

Its especially helpful for the businesses lenders that assessability of the business to repay their dues. Where TV n Terminal Value at the end of the specified period.

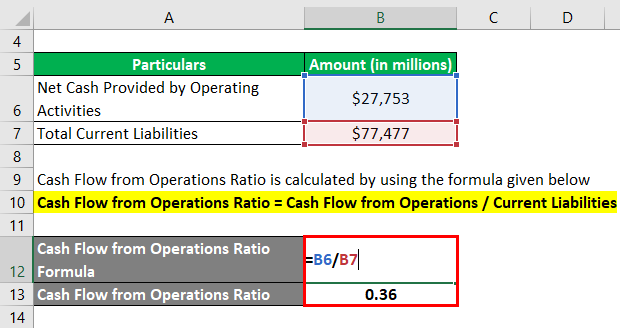

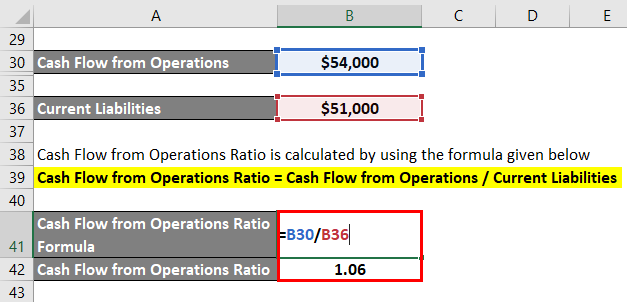

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

The bulk of the positive cash flow stems from cash earned from operations which is a good sign for investors.

. We continue to execute our 2022 plan with production guidance. Under the perpetual growth rate method the terminal value is calculated as. The current ratio is an essential financial matric that helps to understand the liquidity structure of the business.

Cash flow per share Operating Cash Flow Outstanding Shares. NuVista or the Company TSXNVA is pleased to announce record-setting financial and operating results for the three and six months ended June 30 2022 and to provide a number of updates which demonstrate continued material advancement of our Pipestone and Wapiti. In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed.

Dmart have the following information available for the financial year-end. This leaves a sample of 1496 firms each firm appears only once in this analysis. Given the figures above the computed days in inventory is 84 days which can be considered a high ratio compared to the industry average.

WACC The Weighted Average Cost of Capital Weighted Average Cost Of Capital The weighted average cost of capital WACC is the average. Cash Flows Valuation Using Capital Cash Flow Method Comparing It with Free Cash Flow Method and Adjusted Present Value Method in Companies Listed on Tehran Stock Exchange Business Intelligence. The average for each of these annual figures over the complete 20 year period was 143Compare this to the 89 average from the research I did on historical average net margins.

The price-to-cash-flow PCF ratio is the companys worth based on its cash flow. Price-to-cash-flow ratio Share price operating cash flow outstanding shares. By comparing a companys available free cash flow along with a profitability metric the FCF conversion rate helps evaluate the quality of a companys cash flow generation.

The solvency ratio differs from industry to industry so the solvency ratio greater than 20 is considered that the company is financially healthy. Investors use this metric to see if the company valuation is fair and how much cash their investment generates. Next the cost of goods sold can also be easily retrieved from the income statement.

To examine whether governance structures are designed in response to free cash flow related agency costs I average annual measures of free cash flow for firms with available Compustat data for the period 19972002 and governance data for the 2002 fiscal year. TV n CFn 1g WACC-g. CF n The cash flow of the last specified period.

From this CFS we can see that the net cash flow for the 2017 fiscal year was 1522000. G the growth rate. Operating cash flow is positive while the company has to invest every year in the maintenance and upgrade of its machinery park.

A nice rule of thumb shortcut would be to remember that net margin probably averages around 10 and operating margin averages around 5 more than that. In other words the operating margin ratio demonstrates how much revenues are left over after all the variable or operating costs have been paid. Average Price to Cash flow ratio of these top companies is around 1383x.

The Weighted Average Cost of Capital WACC is one of the key inputs in discounted cash flow DCF analysis and is frequently the topic of technical investment banking interviews. Retail is an industry that is expected to generate cash on a day-to-day basis and its easy for lenders to get. Higher the solvency ratio good for the company and vice versa.

The Average Current Ratio for Retail Industry. The company also uses Financial Debt which shows up on the Balance Sheet. Of the company at a very subtle level by allowing the investor to compare a specific company to the peer company in the industry as a whole.

Total Revenue Number of Units Sold Average Selling Price Per Unit. So calculate the solvency ratio from below. Otherwise the total revenue can also be computed by multiplying the total number of units sold during a specific period of time and the average selling price per unit.

The operating margin ratio also known as the operating profit margin is a profitability ratio that measures what percentage of total revenues is made up by operating income. The Free Cash Flow Conversion Rate is a liquidity ratio that measures a companys ability to convert its operating profits into free cash flow FCF in a given period. Margin Enhancement Through Reduced Per Unit Cash Costs Cash costs per boe 6 associated with operating transportation GA and interest expense totaled 963 per boe in Q222 a 22 decrease from 1233 per boe in Q221 contributing to a 179 increase in operating netback 6 to 3892 in Q222 over Q221 aligning with the goals in our Two.

03 2022 GLOBE NEWSWIRE NuVista Energy Ltd. The WACC is the rate at which a companys future cash flows need to be discounted to arrive at a present value for the business. CALGARY Alberta Aug.

We remain intensely focused on maintaining capital discipline and driving meaningful free cash flow in our business.

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Adequacy Ratio Formula And Calculator Excel Template

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Definition

Operating Cash Flow Ratio Calculator

Cash Flow To Debt Ratio Meaning Importance Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

How Are Cash Flow And Free Cash Flow Different

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Formula Guide For Financial Analysts